Discovering Effective Business Funding Options for Professionals: A Comprehensive Guide

Maneuvering the landscape of service funding can be a pivotal obstacle for professionals. With different alternatives available, from conventional car loans to ingenious crowdfunding systems, each presents special benefits and prospective risks. Specialists should assess their details needs and financial conditions to establish one of the most ideal course. As the demand for reliable funding techniques expands, recognizing exactly how to leverage these sources comes to be vital for sustainable success. What selections will form their future?

Understanding Standard Finances for Professional

Steering the landscape of conventional finances can be necessary for professionals seeking to finance their business undertakings. These financings normally use an organized technique to safeguarding funding, which can be important for various operational requirements, consisting of tools purchases, advertising initiatives, or employing staff - Business Funding. Experts usually rely on financial institutions or cooperative credit union, where they can access term finances or lines of credit scores tailored to their economic accounts. To qualify, a specialist needs to show credit reliability, commonly via credit report ratings and economic statements, which reflect their ability to repay the funding. Passion rates and settlement terms differ, making it significant for professionals to contrast deals carefully. Additionally, recognizing the effects of collateral demands can influence car loan choices. Generally, typical finances offer a viable financing alternative for consultants who are prepared to navigate the intricacies of the application process and satisfy loan provider assumptions

Exploring Grant Opportunities for Consulting Projects

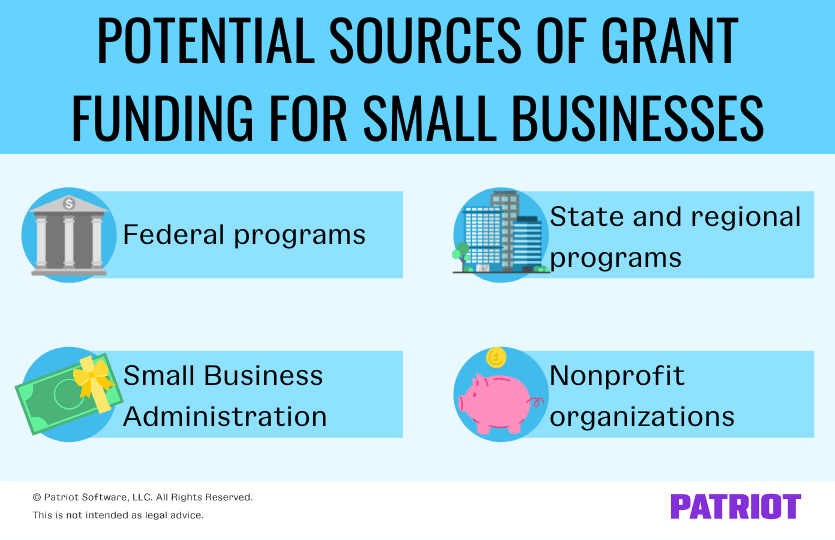

For consultants looking for option funding avenues, discovering grant chances can be a beneficial technique. Grants, usually provided by federal government entities, foundations, and nonprofit organizations, can supply financial backing without the worry of repayment. These funds can be specifically marked for projects that advertise innovation, community development, or sector-specific initiatives, making them specifically beneficial for consultants concentrated on impactful work.

Consultants ought to begin by identifying grants pertinent to their competence or target market. This includes looking into offered chances, comprehending eligibility criteria, and straightening project objectives with give purposes (Business Funding). Additionally, crafting an engaging proposition is essential, highlighting the job's potential benefits and results

The Power of Crowdfunding in the Consulting Industry

Although standard funding sources continue to be preferred, several experts are increasingly turning to crowdfunding as a feasible choice to finance their projects. This ingenious funding method permits professionals to provide their ideas to a broad target market, allowing them to collect financial support from people who count on their vision. Platforms like Kickstarter and Indiegogo supply an area for experts to showcase their competence and the value of their services, attracting both big and small financiers.

Crowdfunding not just elevates capital but also works as a marketing device, helping professionals construct a neighborhood around their brand name. Involving possible clients early in the procedure produces useful links and insights that can form job growth. In addition, effective campaigns can enhance reputation, showcasing an expert's capacity to draw in rate of interest and assistance for their efforts. As the consulting landscape evolves, crowdfunding arises as a dynamic and reliable funding strategy for enthusiastic experts.

Alternative Funding Techniques for Rapid Growth

How can consultants take advantage of alternate funding methods to accomplish rapid growth? Consultants can check out choices such as peer-to-peer loaning, invoice funding, and revenue-based financing. Peer-to-peer lending systems connect specialists with specific financiers, supplying quicker access to capital without typical financial institution examination. Invoice financing permits professionals to get instant funds versus superior billings, boosting cash circulation and making it possible for investment in development methods. Revenue-based funding provides funding in exchange for a percent of future earnings, lining up the financing terms with the expert's earnings stream.

Furthermore, experts might think about collaborations with capitalists that provide funds in exchange for equity, providing not just capital but likewise useful market connections. These alternate financing choices can be tailored to fulfill certain company requirements, promoting a fast-tracked development trajectory while decreasing danger. try these out By strategically using these methods, consultants can properly place themselves for expansion and enhanced market competition.

Selecting the Right Funding Choice for Your Consultancy

Consultants have to assess various financing alternatives to discover the most effective suitable for their one-of-a-kind organization needs. Variables such as organization phase, growth potential, and monetary health play important roles in this decision-making procedure. For developed specialists, typical bank lendings might provide desirable terms, while more recent firms could consider individual financial savings or crowdfunding to reduce monetary danger.

Equity funding can additionally be an alternative, enabling professionals to bring in partners that share their vision, but this may thin down possession. Additionally, federal government gives and aids provide non-repayable funding, albeit with strict eligibility criteria.

Specialists should additionally explore alternative financing approaches, such as invoice factoring or credit lines, which can give fast access to capital. By evaluating each alternative's obstacles and advantages, professionals can make informed decisions that line up with their monetary method and long-lasting objectives.

Regularly Asked Inquiries

What Are the Risks Connected With Different Funding Options?

The threats associated with different financing choices consist of high-interest prices, equity dilution, settlement commitments, prospective loss of control, and dependence on rising and fall market problems. Each financing resource carries special obstacles that call for careful consideration by organizations.

Just How Can I Boost My Opportunities of Getting Financing?

To improve chances of protecting financing, one must develop a strong business plan, demonstrate a clear worth proposition, develop a solid credit visit here profile, network effectively, and prepare for thorough due diligence by potential capitalists or loan providers.

What Is the Typical Timeline for Financing Approval?

The typical timeline for moneying authorization varies, normally ranging from a few weeks to numerous months (Business Funding). Aspects affecting this timeline include the financing resource, application efficiency, and the intricacy of the recommended organization plan

Exist Details Financing Options for Niche Consulting Locations?

Yes, niche consulting locations typically have details financing choices, consisting of grants tailored to specialized markets, financial backing concentrated on ingenious solutions, and crowdfunding platforms that deal with unique organization recommendations within those particular niches.

Just How Can I Take Care Of Capital After Obtaining Financing?

To handle capital after getting funding, one must develop an in-depth budget, monitor expenditures very closely, prioritize vital prices, develop a book for emergencies, and on a these details regular basis review monetary projections to adapt to altering circumstances.

Steering the landscape of company financing can be a pivotal obstacle for professionals. For consultants looking for choice funding avenues, discovering grant possibilities can be an important technique. Typical financing resources stay prominent, numerous consultants are significantly turning to crowdfunding as a practical alternative to fund their tasks. Consultants can explore choices such as peer-to-peer borrowing, invoice funding, and revenue-based financing. Consultants must assess different funding choices to find the finest fit for their unique organization demands.